REITs achieve this week on optimism surrounding Q3 outcomes

[ad_1]

Michael Edwards

REITs largely completed in inexperienced this week on the optimism surrounding the Q3 outcomes.

Crown Fortress (CCI) had a powerful Q3, whereas Prologis’ (PLD) Q3 earnings topped consensus. SL Inexperienced Realty (SLG) reported a beat, and Rexford Industrial Realty (REXR), First Industrial Realty Belief (FR) and Brandywine Realty Belief (BDN) additionally reported strong Q3 outcomes.

The sector’s stability sheets are the strongest they’ve ever been, in accordance with Searching for Alpha writer Riyado Sofian.

Debt Ratio is at solely 35%, lease lengths are for much longer and curiosity protection ratio is at all-time highs, the writer mentioned.

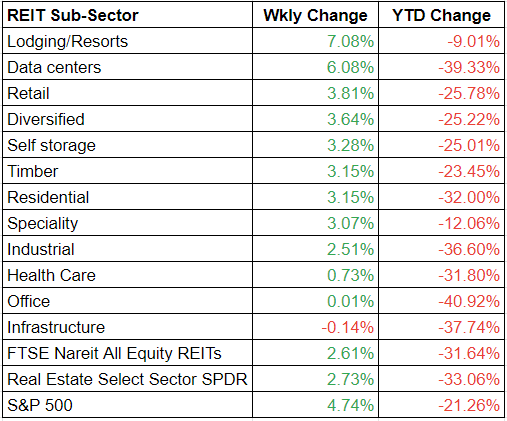

With optimism round REITs’ outcomes and a restoration within the journey business, Lodge REITs gained probably the most in worth this week, i.e. 7.08%. That is greater than the broader S&P 500 index, which completed 4.74% larger in comparison with the earlier week.

The sector’s fundamentals stay strong, however macro considerations are dominating, in accordance with a Baird report.

For Q3, “we’re not anticipating anyplace close to the magnitude of beats that occurred throughout 1Q22 or 2Q22 earnings,” the report famous, having additionally mentioned that the company continues to see worth within the group at present ranges.

The second main gainer for the week was the knowledge middle sub-sector, having completed 6.08% larger than the earlier week.

Knowledge middle REITs have the benefit of with the ability to largely move by rising energy prices to prospects by way of larger rents, in accordance with Jefferies analyst Jonathon Peterson, who believes this sub-sector is among the many finest fitted to a stagflation surroundings.

Infrastructure was the most important laggard, the one sub-sector to proceed declining in worth on a weekly foundation.

Source link