Will fewer flights and better costs assist United Airways take off in Q3?

[ad_1]

Ryan Fletcher/iStock Editorial through Getty Pictures

United Airways (NASDAQ:UAL) is scheduled to announce Q3 earnings outcomes on Tuesday, October 18th, after market shut.

The consensus EPS Estimate is $2.28 (+323.5% Y/Y) and the consensus Income Estimate is $12.74B (+64.4% Y/Y).

Earnings Historical past: The airways turned worthwhile in Q2 however missed the consensus mark.

However CEO Scott Kirby mentioned it was targeted on confronting three dangers that might develop over the following 6-18 months: industry-wide operational challenges, file gasoline costs, and the rising chance of a world recession.

Over the past 2 years, UAL has overwhelmed EPS estimates 38% of the time and has overwhelmed income estimates 38% of the time.

Over the past 3 months, EPS estimates have seen 4 upward revisions and 5 downward. Income estimates have seen 5 upward revisions and a couple of downward.

Firm’s Outlook: For Q3, the corporate mentioned it expects complete working income to be up round 12% vs. 3Q19 and prior outlook of +11%. Capability to be down 10% to 11% vs. 3Q19. Adjusted working margin to be ~10.5% vs. prior outlook of 10%.

The corporate continues to count on to be worthwhile for FY2022 even with greater gasoline costs a giant consideration. UAL can be assured that it may possibly hit a goal of 9% adjusted pretax margin in 2023 and 14% by 2026.

Analyst Rankings: Barclays analyst Brandon Oglenski cuts value goal to $39 from $45 and maintains an Equal Weight score on the shares. The analyst says that regardless of “probably favorable” near-term income outlooks by most airways, he materially decreased 2023 earnings forecasts reflecting softer demand expectations and just lately greater gasoline costs. The Q3 earnings season may convey some brighter information on U.S. journey demand “relative to a extra somber transport outlook,” Oglenski tells buyers in a analysis word. Nonetheless, he decreased airline demand expectations in 2023 with EBITDAR estimates coming down roughly 20%.

Peer Delta (DAL) reported combined Q3 earnings on final Thursday and sees This fall capability up by ~5% to 9% vs. 4Q19; Working Margin: to be 9% to 11%; EPS between $1 to $1.25 vs. consensus of $0.80. General, DAL is on observe to attain 2024 targets of over $7 EPS and $4B of free money circulate.

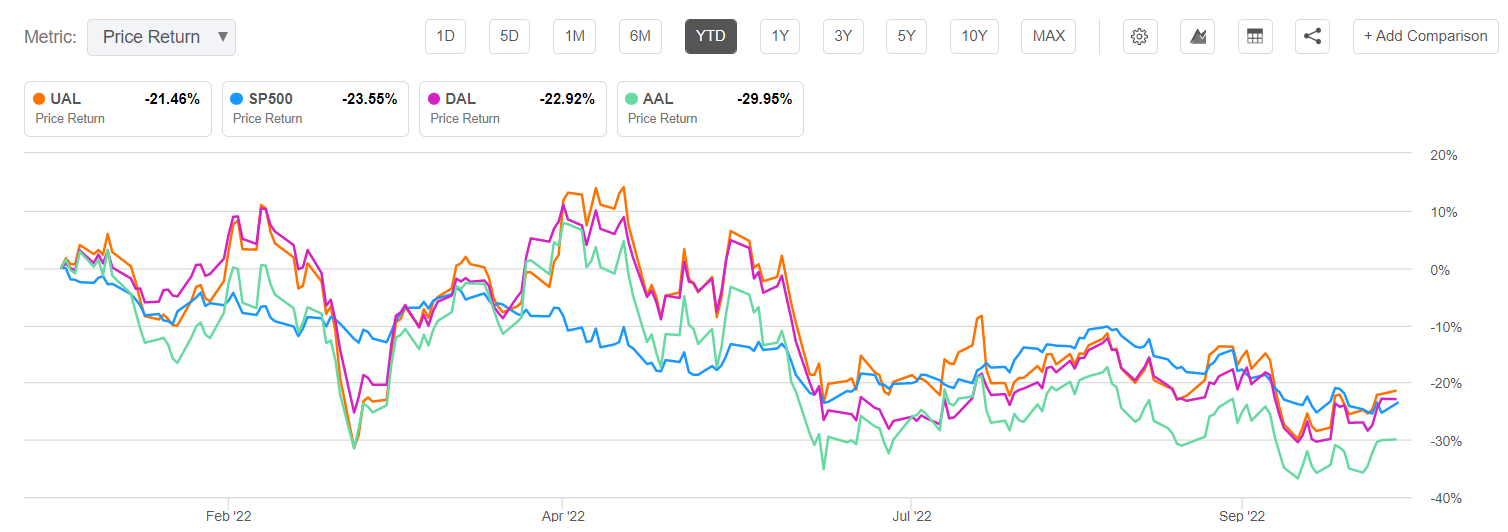

UAL is down 21.5% for the reason that begin of 2022 however not as steep because the S&P 500’s -24%.

Source link