Will regional banks proceed financials’ Q3 successful streak tomorrow?

[ad_1]

R.M. Nunes

Will regional banks proceed the Q3 successful streak for the monetary sector tomorrow?

Truist Monetary (TFC), Silvergate Capital (SI), Signature Financial institution (SBNY) and Commerce Bancshares (CBSH) are set to report their Q3 earnings outcomes tomorrow, Oct. 18, earlier than market open, whereas First Horizon (FHN) will report it after market shut.

With web curiosity earnings enjoying a dominating function within the income construction of all of the banks, the development is predicted to be continued.

Banking and broad spectrum financial-based alternate traded funds confirmed power in Monday’s early buying and selling after they acquired a lift from Q3 earnings figures delivered by Financial institution of America.

Financial institution of New York Mellon, Citigroup, JPMorgan Chase, Morgan Stanley, Wells Fargo and U.S. Bancorp additionally reported a beat of their Q3 outcomes, pushed by increased web curiosity earnings on account of the rising rates of interest.

Regional banks have proven comparable developments by way of their quarterly outcomes till now.

First Republic Financial institution’s (FRC) Q3 GAAP EPS of $2.21 beats by $0.02 and income of $1.57B (+17.2% Y/Y) beats by $20M.

Washington Federal’s (WAFD) inventory rose ~6% on Friday after the corporate’s FQ4 earnings beat estimates. PNC Monetary (PNC) inventory superior as a lot as 2% in Friday premarket buying and selling after its Q3 earnings exceeded Wall Road expectations as loans, web curiosity margin and costs continued to push up.

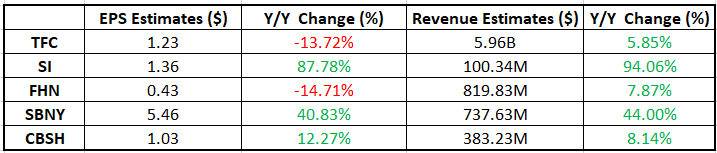

Analysts count on revenues to rise Y/Y for all of the regional banks reporting tomorrow. Nonetheless, that isn’t the case for EPS.

Here’s a take a look at the Q3 estimates:

During the last 2 years, FHN has crushed EPS estimates 88% of the time and income estimates 38% of the time. During the last 3 months, EPS and income estimates have seen 3 upward revisions and 0 downward revisions.

During the last 2 years, TFC has crushed EPS estimates 100% of the time and income estimates 75% of the time. During the last 3 months, EPS estimates have seen 3 upward revisions and eight downward revisions. Income estimates have seen 2 upward revisions and three downward revisions.

In the meantime, during the last 1 yr, SI has crushed EPS and income estimates 100% of the time. During the last 3 months, EPS estimates have seen 5 upward revisions and a pair of downward revisions. Income estimates have seen 6 upward revisions and 1 downward revision.

And, during the last 1 yr, SBNY has crushed EPS and income estimates 50% of the time. During the last 3 months, EPS estimates have seen 4 upward revisions and 11 downward revisions. Income estimates have seen 1 upward revision and seven downward revisions.

For CBSH, during the last 3 months, EPS estimates have seen 4 upward revisions and a pair of downward revisions. Income estimates have seen 3 upward revisions and 1 downward revision.

Source link