Will Intuitive Surgical Q3 earnings convey constructive shock amid COVID woes, inventory influence

[ad_1]

LL28/E+ through Getty Pictures

Intuitive Surgical (NASDAQ:ISRG) is scheduled to announce Q3 earnings outcomes on Tuesday, October 18th, after market shut.

The consensus EPS Estimate is $1.12 (-5.9% Y/Y) and the consensus Income Estimate is $1.52B (+8.6% Y/Y).

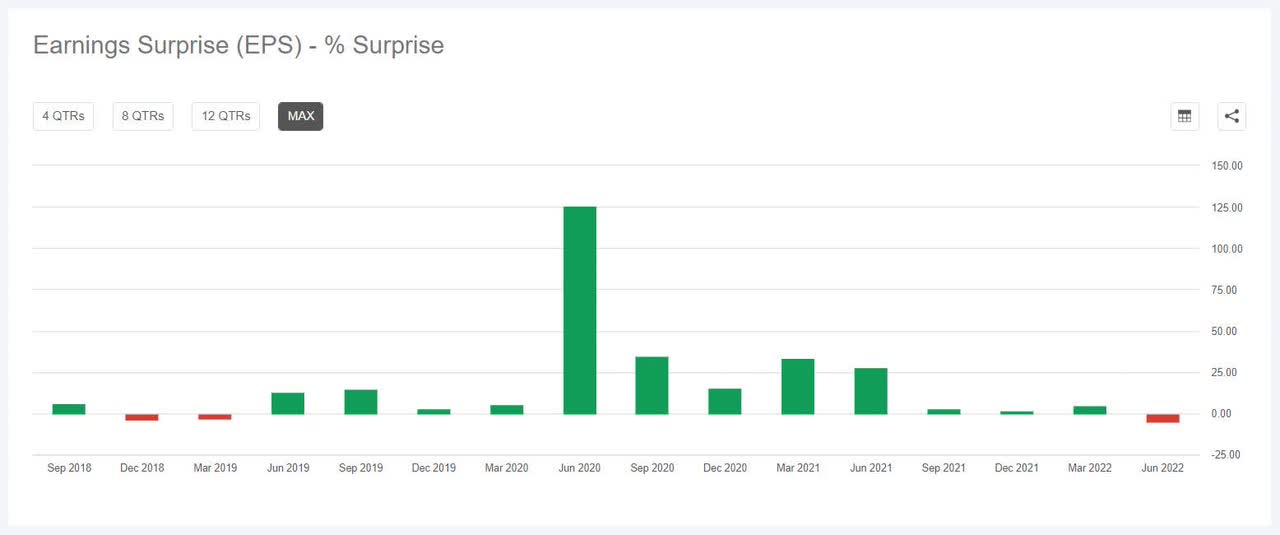

Over the final 2 years, ISRG has overwhelmed EPS estimates 88% of the time and has overwhelmed income estimates 88% of the time.

Over the past 3 months, EPS estimates have seen 0 upward revisions and 16 downward. Income estimates have seen 2 upward revisions and 13 downward.

The medical gadget maker’s inventory fell -5.74% on July 22, the day after reporting its Q2 outcomes (July 21 post-market). The corporate’s Non-GAAP EPS and income, each missed analysts’ estimates, ending a run of 12 straight quarterly beats.

In Q2, procedures with the da Vinci surgical methods grew ~14% Y/Y, amid COVID influence. The corporate positioned solely 279 da Vinci Surgical Programs, down -15%, in comparison with 328 in Q2 2021.

Intuitive stated in its Q2 earnings launch that that COVID-19 is prone to proceed to have an antagonistic influence on its process volumes.

YTD, ISRG inventory has taken a deep hit, having declined ~47%, nearly double than the broad market indicator SP500 (~24%), see chart right here. The SA Quant Score on the shares is Maintain, which takes under consideration elements akin to Momentum, Profitability, and Valuation amongst others. ISRG has an A+ issue grade for Profitability however D- for Progress. The typical Wall Avenue Analysts’ Score differs with a Purchase score, whereby 9 out of 23 analysts see the inventory as Sturdy Purchase.

A day in the past, SA contributor InvestOhTrader wrote that Intuitive’s slowing high line development efficiency and pressured margin makes the inventory unattractive (as of the publication date).

Throughout Q3, Japan authorised the corporate’s da Vinci single-port surgical system to be used in surgical procedures. The nation had first cleared Intuitive’s multi-port system in 2009.

Intuitive additionally signed an settlement to get provide of Luna Improvements’ photonic subsystems to be used in its robotic surgical methods.

Current earnings Evaluation from our contributors:Intuitive Surgical: Shares Nonetheless Expensive, However Technical Assist In Play Forward Of Earnings

Source link