‘Me too’ investing is consuming returns • TechCrunch

[ad_1]

For an asset class that needs to be reinventing itself on a regular basis, it’s shocking to see how resistant some enterprise funds are to vary.

As a accomplice in a fund of funds, I attend numerous annual conferences, speak with numerous enterprise fund common companions and overview numerous investor decks.

What has notably stunned me is what number of funds inform precisely the identical story and spend money on precisely the identical areas: B2B SaaS, cybersecurity, cloud infrastructure tech, e-commerce manufacturers and crypto/fintech.

As I’ve written many occasions earlier than, enterprise is about elephant looking. Nice funds have a minimum of one, and ideally a number of, enormously profitable, fund-returning investments. Possession and letting the good firms “journey” (and never promoting them early) is essential to getting outsized returns.

However, the outsized returns solely come from firms which might be market leaders in huge markets. The second-place firm, and generally, the third-place firm can win, too, however in fact won’t be as massive. However the firms that find yourself at #300 or #99 and even #20 in a market don’t find yourself nearly as good investments.

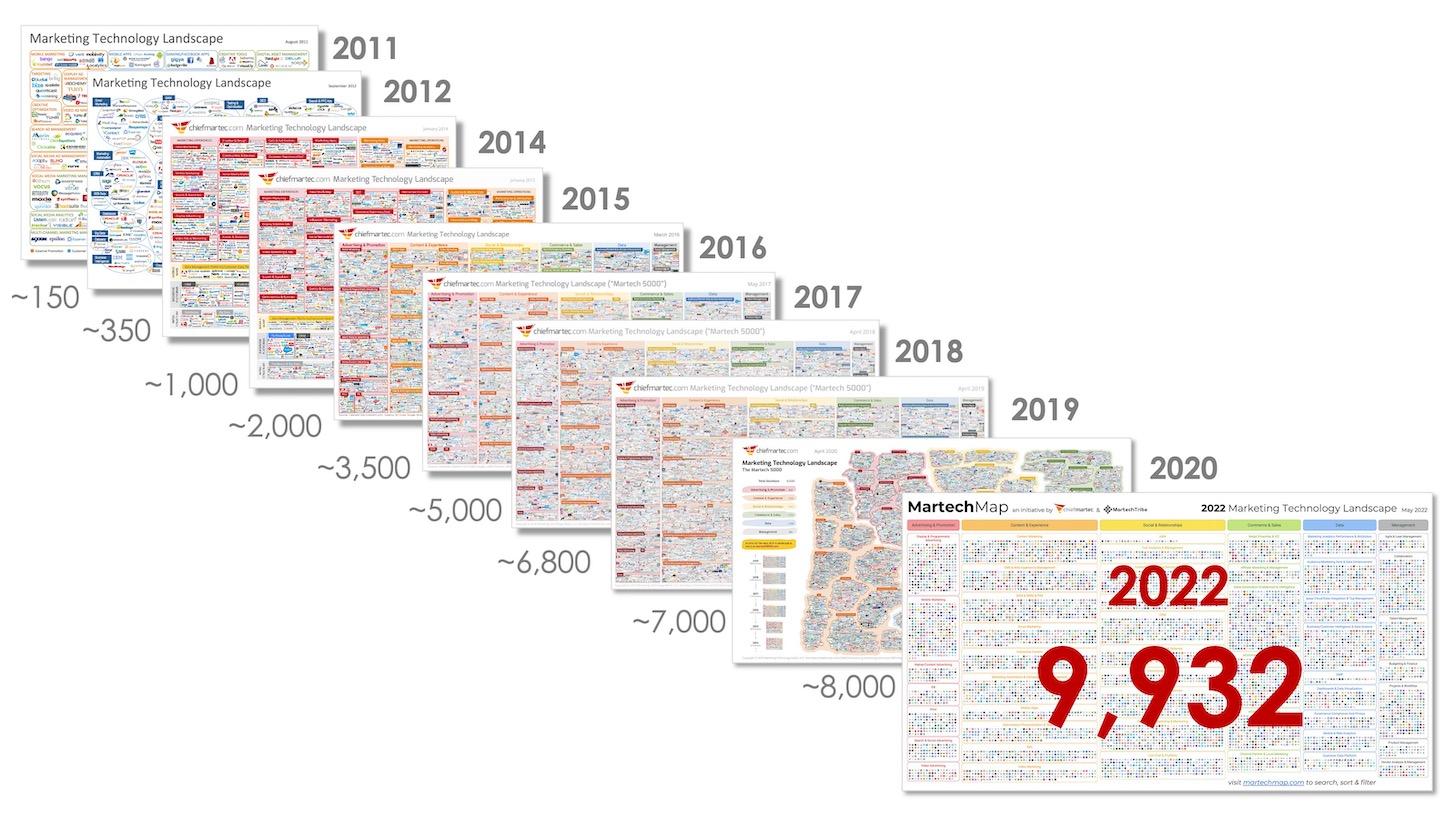

I used to be fascinated with this lately once I checked out a map of martech SaaS firms that chiefmartec and MartechTribe ready lately. What’s superb is what number of advertising SaaS firms nonetheless get funded:

Picture Credit: Scott Brinker of chiefmartec and MartechTribe

Whereas not practically as dangerous as advertising tech, we’re seeing an enormous inflation within the variety of cybersecurity and fintech firms as properly.

A remark that I more and more hear in my conversations with CISOs, for instance, is that they aren’t wanting as a lot for brand spanking new level options as a lot as a broader platform that may exchange tens of the various cybersecurity functions they’ve of their programs. In a market the place capital might be more and more troublesome to lift, lots of the hundreds of “me too” cybersecurity firms will discover themselves turning into more and more “insecure.”

The identical is true for some areas of fintech. What number of extra fee firms will be created? What number of extra e-commerce finance firms can survive and flourish?

Marc Andreessen as soon as stated that “software program is consuming the world.” Sadly, me-too investing is consuming returns.

So, what ought to enterprise funds do?

As an early-stage VC, it’s not necessary to spend money on what’s scorching at the moment, however investing what might be scorching in 5 to 10 years from now. The VCs that spend money on the leaders of tomorrow’s markets would be the ones who generate outsized returns.

That doesn’t imply one must cease investing in SaaS, cybersecurity or fintech. There’ll at all times be disruptive firms in these segments, however the steadiness must shift to the huge markets ripe for disruption by applied sciences which might be underfunded.

For my part, there are 4 comparatively underfunded areas that might produce enormous winners over the subsequent 10 years:

Source link