The largest menace at present is recession, not inflation

[ad_1]

The U.S. Federal Reserve has been elevating charges too rapidly, and recession dangers will probably be “extraordinarily” excessive if it continues to take action, stated Jeremy Siegel, professor emeritus of finance on the Wharton Faculty of the College of Pennsylvania.

“They need to have began tightening a lot, a lot a lot earlier,” he advised CNBC’s “Avenue Indicators Asia” on Friday. “However now I worry that they are slamming on the brakes approach too onerous.”

Siegel stated he was one of many first to warn of the Fed’s “inflationary insurance policies” in 2020 and 2021, however “the pendulum has swung too far within the different path.”

“In the event that they keep as tight as they are saying they’ll, persevering with to hike charges by means of even the early a part of subsequent yr, the dangers of recession are extraordinarily excessive,” he stated.

A lot of the inflation is behind us, after which the most important menace is recession, not inflation, at present.

Jeremy Siegel

Wharton professor

Official knowledge, which usually lags by a month, might not instantly present the adjustments occurring in the true financial system, he stated. “A lot of the inflation is behind us, after which the most important menace is recession, not inflation, at present.”

Siegel stated he thinks rates of interest are excessive sufficient that they might convey inflation right down to 2%, and the terminal price, or finish level, needs to be between 3.75% and 4%.

In September, the Fed raised benchmark rates of interest by one other three-quarters of a proportion level to a variety of three%-3.25%, the best it has been since early 2008. The central financial institution additionally signaled that the terminal price could possibly be as excessive as 4.6% in 2023.

“I feel that that’s approach, approach too excessive — given the coverage lags, that basically would drive a contraction,” he stated.

Based on the CME Group’s FedWatch tracker of Fed funds futures bets, the likelihood that the goal vary of charges will attain 4.5% to 4.75% in February subsequent yr is at 58.3%.

If it have been as much as him, Siegel stated, he would hike charges by half a degree in November, then wait and see. If commodity costs begin to rise and cash provide will increase, the Fed must do extra.

“However my feeling is that once I have a look at delicate commodity costs, asset costs, housing costs, even rental costs, I see declines, not will increase,” he stated.

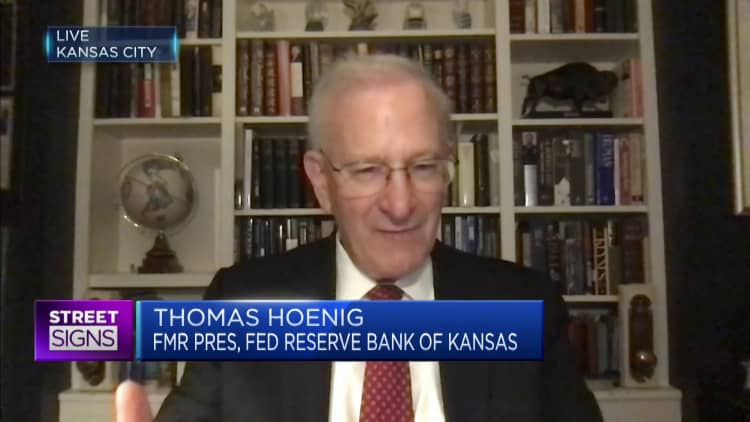

However not everybody agrees. Thomas Hoenig, former president of the Federal Reserve Financial institution of Kansas Metropolis, stated charges must be larger for longer.

“My very own view is you have to get the speed up. If inflation is 8%, it is advisable to get the speed up a lot larger,” he advised CNBC’s “Avenue Indicators Asia.”

“They should keep there and never again off of that too quickly to the place they reignite inflation, say within the second quarter [of] 2023 or the third quarter,” he added.

— CNBC’s Jihye Lee contributed to this report.

Source link