Cramer says financial knowledge can’t seize one big driver of inflation

[ad_1]

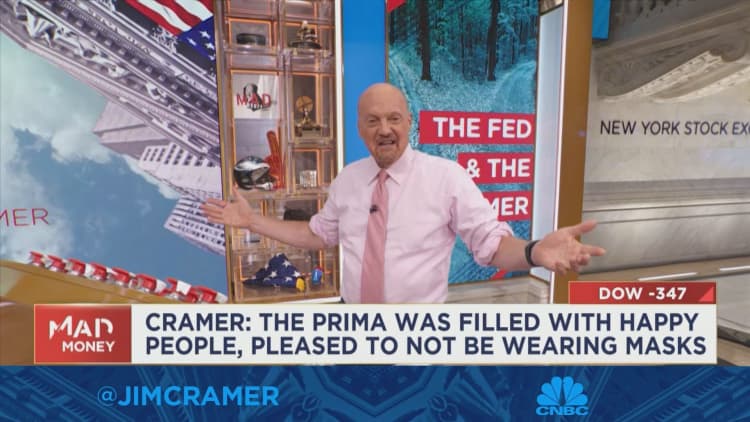

CNBC’s Jim Cramer on Thursday stated that an enormous driver of inflation is the buyer’s need to spend cash within the reopening economic system – a proven fact that is not mirrored within the knowledge that the Federal Reserve and Wall Road are poring over.

“They do not care about larger charges. They’ve financial savings as a result of they did nothing for 2 years,” he stated. “My largest fear proper now could be that the combination knowledge cannot seize the character of this … one-time-only euphoria.”

Shares slumped on Thursday after a powerful begin to the week that fizzled out by Wednesday. Buyers are eyeing the nonfarm payrolls report launch on Friday to gauge the dimensions of the Federal Reserve’s subsequent rate of interest hike.

If job and wage development is stronger than anticipated, the Fed is prone to keep the course on its aggressive marketing campaign.

Whereas a surge in journey this summer season confirmed that Individuals have been keen to interact in revenge journey after Covid restrictions loosened, some are additionally now experiencing “recession fatigue” – waning motivation to proceed making sensible monetary decisions to organize for robust financial occasions forward.

Cramer famous that he expects shoppers’ have to spend to wind down finally, although it may not occur anytime quickly.

“A yr from now, there most likely shall be no euphoria. It will be over. They’re going to have spent their extra financial savings. And that is precisely when rates of interest will possible be at their max,” Cramer stated.

Source link