Washington sees OPEC+ deliberate oil manufacturing cuts as political: Yergin

[ad_1]

Washington sees OPEC+’s resolution to slash oil manufacturing by greater than 2 million barrels a day as political interference and a “blow” in opposition to U.S. President Joe Biden, stated Dan Yergin, vice chair of S&P World.

On Wednesday, the group of a number of the world’s strongest oil producers agreed to impose deep output cuts to shore up crude costs regardless of calls from the U.S. to pump extra to assist the worldwide financial system.

associated investing information

“That is seen as, initially, a blow in opposition to Biden who got here to Saudi Arabia. Secondly, it is seen as one way or the other political interfering within the U.S. election, though the reduce would not go into impact till November.”

The choice, which was made at OPEC and OPEC+’s first in-person assembly in Vienna since 2020, would mark the most important reduce for the reason that pandemic started.

Biden visited the Saudi authorities in July in a bid to ramp up oil manufacturing and management hovering vitality costs.

Oil costs rose to a three-week excessive on Wednesday after the announcement following three days of rallying. The West Texas Intermediate climbed 1.4% to $87.76 per barrel, whereas the Brent crude rose 1.7% to $93.37 a barrel in early commerce.

Oil as a weapon

“The OPEC+ would possibly discover itself in opposition to the West with weaponized oil,” stated Vishnu Varathan, head of economics and technique at Mizuho Financial institution, in a notice.

He wrote that the oil provide cuts are “seen partly as a protestation of Russian oil worth caps” and confirms the group’s “bare need for worth buoyancy, not simply help.”

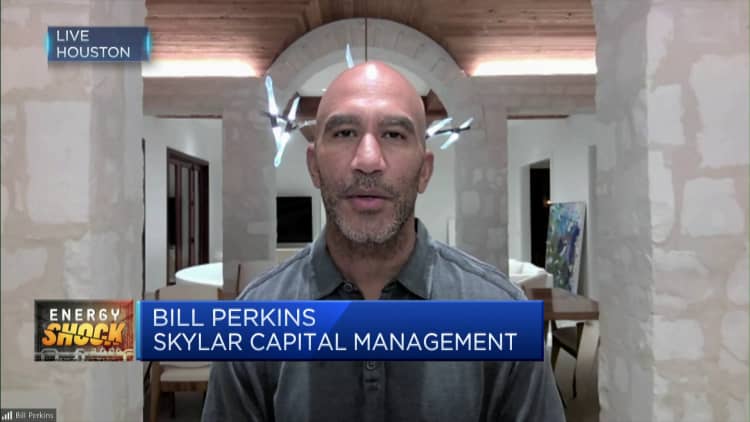

Representatives of OPEC member international locations attend a press convention after the forty fifth Joint Ministerial Monitoring Committee and the thirty third OPEC and non-OPEC Ministerial Assembly in Vienna, Austria, on Oct. 5, 2022. “There appears to be a mini battle between [Strategic Petroleum Reserve] releases within the White Home and what is going on on with OPEC+,” stated Invoice Perkins, CEO of Skylar Capital Administration.

Vladimir Simicek | AFP | Getty Pictures

A manufacturing reduce of round 1,000,000 barrels a day would have led to cost positive aspects with out compromising on quantity, however the bigger discount exhibits the group’s “disregard for the financial woes of, and geo-political alignment with, international companions,” Varathan added.

Yergin, likewise, stated the settlement is seen “not in financial phrases” however as being extra political in nature.

The choice additionally comes because the EU reached an settlement on capping Russian oil costs as a part of a brand new sanctions bundle.

“The Russians have signaled on this case and different circumstances that they’re going to do all the pieces they’ll to frustrate a worth cap on oil,” Yergin stated.

‘Harmful sport’

“There appears to be a mini battle between [Strategic Petroleum Reserve] releases within the White Home and what is going on on with OPEC+,” stated Invoice Perkins, CEO of Skylar Capital Administration.

“Ultimately, OPEC+ goes to win that battle, the SPR will finally run out of meals it could withdraw. In order that’s a harmful sport that we’re taking part in there,” he stated.

A couple of weeks in the past, the U.S. Power Division introduced it could promote as much as 10 million barrels of oil from the SPR for supply in November.

Perkins added that the purpose that the group needs to make is that worth indicators from the markets aren’t sufficient to “induce the funding or the availability response” that it wants.

World oil costs skyrocketed to greater than $120 per barrel after the Russian-Ukraine battle broke out, however have tapered to barely above $80 per barrel within the week earlier than OPEC+’s resolution to slash manufacturing.

Nonetheless, when requested if the alliance’s resolution would encourage extra funding in crude oil manufacturing and infrastructure, Perkins struck a cautious notice.

“It is a good guess, nevertheless it’s a scary world proper now,” he stated.

“Individuals would possibly really feel a little bit bit extra courageous to courageous the macro financial headwinds … That being stated, if there is a big recession, vitality demand is without doubt one of the first issues to go.”

Source link