Greenback creates an ‘untenable scenario’ for threat property – Morgan Stanley

[ad_1]

Darren415

The U.S. greenback (USDOLLAR) is on the again foot Tuesday morning, however the transfer down seems to be extra like a one-day reprieve after the leap within the earlier session and dollar power is anticipated to proceed.

Pound sterling hit an all-time low yesterday, however BoE Governor Andrew Bailey dominated out an emergency hike in charges between meetinga. As well as, the Folks’s Financial institution of China stated it’s elevating threat reserve necessities for banks concerned in ahead overseas trade buying and selling to twenty% from 0%.

The dollar’s power can be an issue for shares, however might hasten the top of the bear market, in response to Morgan Stanley.

Disaster: The “latest transfer within the US greenback creates an untenable scenario for threat property that traditionally has resulted in a monetary or financial disaster, or each,” fairness strategist Mike Wilson stated. “Whereas laborious to foretell such ‘occasions,’ the situations are in place for one, which might assist speed up the top to this bear market.”

“Within the meantime, we stay convicted in our eventual low for the S&P 500 (SP500) (SPY) coming later this yr/early subsequent between 3000-3400 (in step with our base and bear case tactical views, respectively),” Wilson stated.

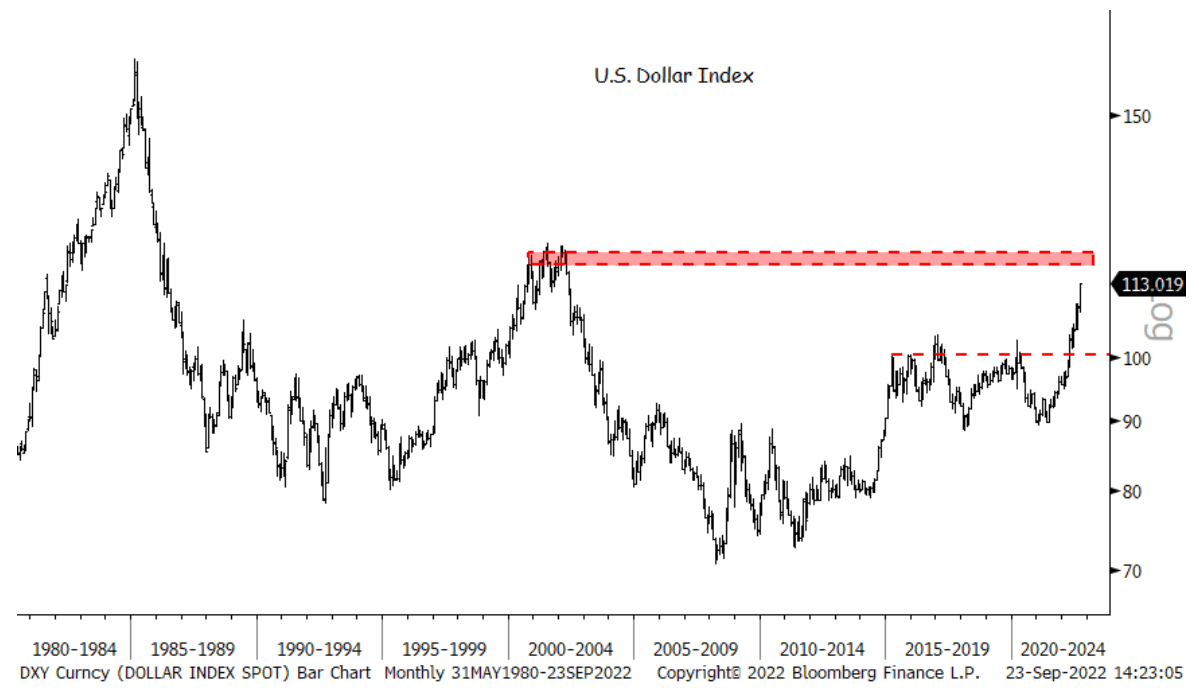

“On a yr over yr foundation, the DXY is now up 21% and nonetheless rising,” he added. “Primarily based on our evaluation that each 1% change within the DXY has round a -0.5% impression on S&P 500 earnings, 4Q S&P 500 earnings will face an approximate 10% headwind to progress all else equal.”

“That is along with different headwinds we’ve been discussing for months – i.e., payback in demand and better prices from inflation to call just a few. It is also vital to notice that such US greenback power has traditionally led to some form of monetary/financial disaster.”

“What’s superb is that this greenback power is occurring whilst different main central banks are additionally tightening financial coverage at a traditionally hawkish tempo,” Wilson stated. “If there was ever a time to be looking out for one thing to interrupt, this is able to be it. Like our charges group, our forex group raised its forecast for the USD. On a DXY foundation, they’re now forecasting a year-end goal of 118, which suggests no reduction in sight, a minimum of basically talking.”

“In our view, such an consequence is strictly how one thing does break, which results in MAJOR high for the US greenback and possibly charges, too. Nonetheless, till that occurs, we predict the screws will solely get tighter for earnings progress and monetary situations.”

Capitulation coming? “US charges are rising because the market reprices peak Fed Funds greater, and equities are being repriced decrease,” Societe Generale macro strategist Package Juckes stated. “This has all of the hallmarks of the beginning of the ultimate stage of the greenback’s rally (a stage which has the capability to be violent and risky).”

From a technical standpoint, BTIG”s Jonathan Krinsky says that the greenback index has room to maneuver as much as 120 (it stands beneath 114 for the time being), however that it a minimum of must pause for equities to backside.

Overseas trade quantity can be at a important degree, Krinsky stated.

Quantity hasn’t “spent a lot time above 12 within the final decade,” he stated. “Doing so would counsel one thing could be breaking, but additionally tends to point capitulation ala March 2020.”

See a deeper dive into the dazzling greenback.

Source link