Bearish Bets: 3 Large Title Shares You Ought to Think about Shorting This Week

[ad_1]

Every week we establish names that look bearish and should current fascinating investing alternatives on the brief facet.

Utilizing technical evaluation of the charts of these shares, and, when acceptable, current actions and grades from TheStreet’s Quant Rankings, we zero in on three names.

Whereas we is not going to be weighing in with elementary evaluation, we hope this piece will give traders fascinated by shares on the way in which down a superb place to begin to do additional homework on the names.

Nvidia Is not Computing

Nvidia Corp. (NVDA) just lately was downgraded to Maintain with a C+ ranking by TheStreet’s Quant Rankings.

Motion Alerts PLUS just lately reduce this title resulting from a extreme breakdown and poor earnings, and the semiconductor maker was downgraded by Quant Rankings because the technicals proceed to erode badly. Cash circulate is again to unfavorable, and whereas a number of up periods would possibly alleviate among the oversold situation the pattern is clearly down.

The cloud is pink and transferring common convergence divergence (MACD) is on a promote sign whereas the chart reveals a constant circulate of decrease highs and decrease lows. When does it cease? That is not our concern.

Put in a cease at $155 and goal the $105 space.

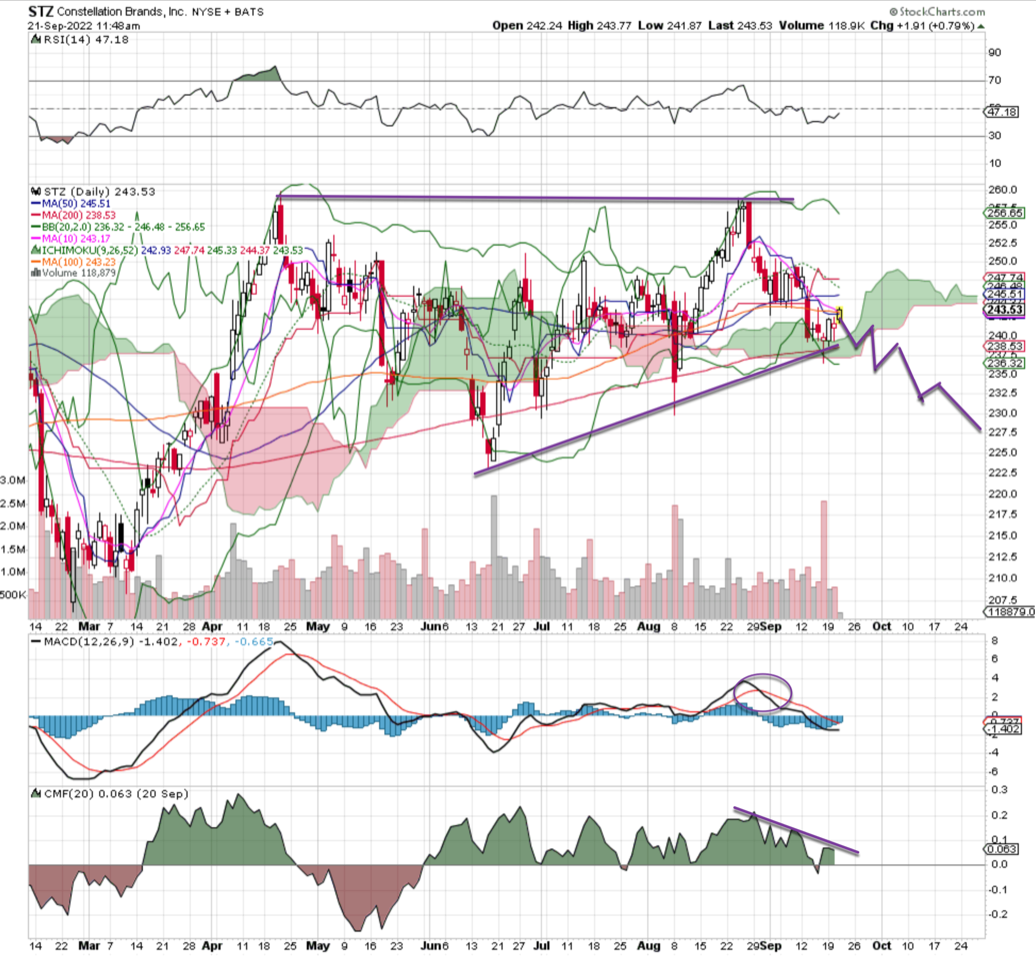

Constellation Manufacturers Goes Flat

Constellation Manufacturers Inc. (STZ) just lately was downgraded to Maintain with a C+ ranking by TheStreet’s Quant Rankings.

The beer, wine and spirits maker typically is a type of go-to names throughout good and dangerous occasions, however its chart is beginning to grow to be challenged. The help line (rising) has been useful of late, however we are able to see clearly the double high shaped from April and August, with excessive quantity round these two rejection areas. This 200-day transferring common take a look at is vital for the bulls, however it might not maintain for lengthy.

MACD is on a promote sign whereas cash circulate is leaking out of the tap. We simply can see extra draw back; put in a cease at $250 and goal the $227 space.

Kraft Heinz Seems Tacky

Kraft Heinz Co. (KHC) just lately was downgraded to Maintain with a C+ ranking by TheStreet’s Quant Rankings.

The meals and beverage maker stays below stress, and with a sequence of decrease highs and decrease lows the pattern is clearly down.

Check out cash circulate, which has flipped bearish, whereas the MACD is on a promote sign. Additionally, the Relative Energy Index (RSI) is bending downward with a steep slope, telling us extra draw back stress is coming.

The current pull-up is a great spot to begin a brief; goal the $29 space and set a cease at $36 simply in case.

(Actual Cash contributor Bob Lang is co-portfolio supervisor of TheStreet’s Motion Alerts PLUS. Wish to be alerted earlier than AAP buys or sells shares? Be taught extra now.)

Get an e mail alert every time I write an article for Actual Cash. Click on the “+Comply with” subsequent to my byline to this text.

[ad_2]Source link