Bitcoin set to submit over 2% weekly loss on waning danger urge for food, FTX aftershock

[ad_1]

designer491

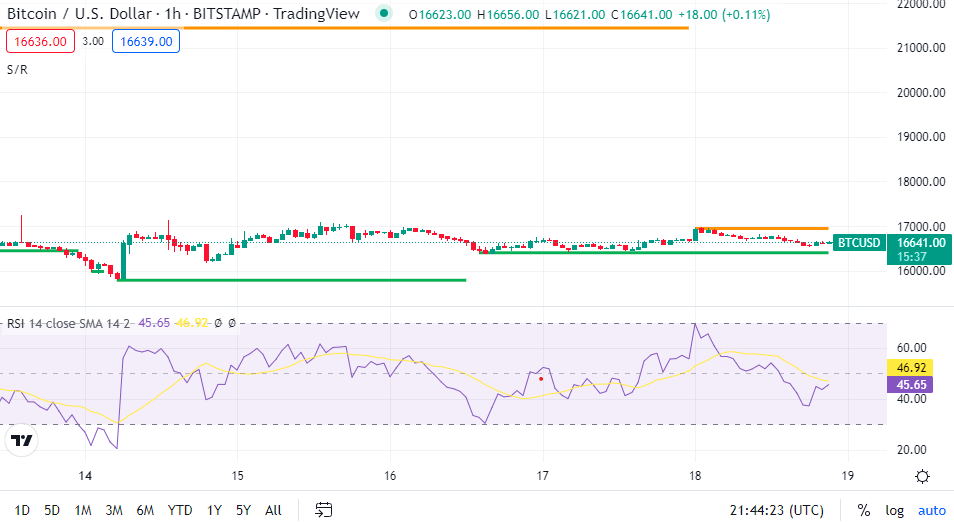

Bitcoin (BTC-USD) is on observe to finish the week over 2% decrease because the after results of the FTX collapse and the broader risk-off setting proceed to weigh on sentiment.

The highest crypto, which has been reeling since cryptocurrency alternate FTX filed for chapter, traded inside a decent vary of $15.9K-$17.1K this week.

Amongst crypto proponents, Binance CEO Changpeng Zhao informed CNBC the trade will emerge higher off after the FTX collapse and extra oversight would not essentially have prevented the disaster. Salvadoran president Nayib Bukele mentioned FTX is the other of bitcoin (BTC-USD) as the highest crypto’s protocol was “created to forestall Ponzi schemes”.

FTX’s new CEO John Ray III slammed the “unprecedented” administration of ex-CEO Sam Bankman-Fried that led to the agency’s demise. Ray, who oversaw Enron’s chapter in 2001, mentioned he’d by no means seen “such a whole absence of reliable monetary info”.

Now, regulators are calling for extra oversight. The U.S. Home Banking Committee is planning to carry a bipartisan listening to subsequent month to scrutinize the FTX collapse.

U.S. Senators Elizabeth Warren (D-MA) and Dick Durbin (D-IL) demanded that FTX make clear its funds, saying its owes the general public clear accounting of its enterprise practices.

Additionally, U.S. Treasury secretary Janet Yellen mentioned crypto markets want more practical oversight, whereas Federal Reserve Vice Chair of Supervision Michael Barr mentioned the U.S. must have sturdy oversight of stablecoins.

Cantor Fitzgerald legislative and regulatory actions within the coming months will outline the trade for years to come back, including that regulated centralized crypto establishments shall be crucial for future adoption.

The FTX fallout claimed many victims this previous week. Genesis International Capital, the lending enterprise of crypto brokerage Genesis, halted redemptions and new mortgage originations as withdrawal requests exceeded its present liquidity. Previous to this, Genesis was reportedly looking for a $1B emergency mortgage from buyers.

Cryptocurrency lender BlockFi is reportedly getting ready to file for chapter safety inside days. Hong Kong-based Genesis Block reportedly mentioned it could halt buying and selling companies to regain a few of its liquidity. Singapore’s state funding fund Temasek is getting ready to jot down off its $275M stake in FTX.

In a observe earlier within the day, Jefferies mentioned bitcoin (BTC-USD) mining was much less worthwhile sequentially in Oct. as the typical value of the coin remained flat whereas community hash fee jumped over 13%. “Community hash fee remained close to historic highs into Nov. regardless of BTC’s value crashing following FTX’s collapse,” it added.

Bitcoin (BTC-USD) dipped 0.23% to $16.66K at 4.55 pm ET, whereas Ethereum (ETH-USD) edged 0.33% increased to $1.21K.

SA contributor Tom Lloyd in an evaluation mentioned bitcoin (BTC-USD) was already in a bear market earlier than the FTX chapter and remains to be diving within the present danger off setting, on the lookout for help and the following bear market bounce.

The worldwide cryptocurrency market cap stands at $832.23B, up 0.09% over Thursday, in accordance with CoinMarketCap.

Crypto-related shares that ended within the pink on Friday embody: Marathon Digital (MARA) -7%, Coinbase (COIN) -7.2%, Riot Blockchain (RIOT) -3.7% and Robinhood Markets(HOOD) -3%.

Source link