FTX needed to let buyers borrow to commerce derivatives: CFTC head

[ad_1]

Sam Bankman-Fried, CEO of cryptocurrency trade FTX, on the Bitcoin 2021 convention in Miami, Florida, on June 5, 2021.

Eva Marie Uzcategui | Bloomberg | Getty Pictures

Sam Bankman-Fried, co-founder of bankrupt crypto agency FTX, spent nearly a yr attempting to persuade regulators to let him introduce a derivatives product that might enable retail buyers to commerce with borrowed cash, in response to Rostin Behnam, chairman of the Commodity Futures Buying and selling Fee.

In an interview with CNBC’s “Squawk Field” on Wednesday, Behnam mentioned Bankman-Fried had been lobbying the CFTC to amend the principles so FTX may let customers commerce derivatives utilizing margin moderately than paying upfront. He additionally needed to supply the contracts on to customers, with out having to undergo a futures fee service provider.

associated investing information

“It might have been a non-intermediated, margined mannequin,” mentioned Behnam, who described the proposal as a “very tough subject from a threat perspective.”

Previous to its chapter submitting final week, FTX had a registered derivatives platform with the CFTC known as FTX US Derivatives. The platform was a rebranding of LedgerX, an organization that FTX acquired in 2021.

FTX US Derivatives is without doubt one of the few FTX-related properties that is not part of its chapter proceedings and stays operational at present. Nonetheless, it seems to have returned to utilizing the LedgerX model. When you go to the FTX US Derivatives web site, it redirects you to ledgerx.com. And Zach Dexter, who was CEO of FTX US Derivatives, says on his LinkedIn profile that he is CEO at LedgerX. The platform lets merchants purchase choices, swaps and futures on bitcoin and ethereum.

Beginning in Dec. 2021, Bankman-Fried and his senior management workforce made frequent visits to the CFTC to advocate for an modification to its current license, Behnam mentioned.

When requested what Behnam considered Bankman-Fried over the course of assembly with him for almost a yr, the chairman mentioned that the previous FTX chief “is aware of markets, a minimum of he tries to counsel that” and he “needed to actually aggressively have this modification handed.”

Bankman-Fried’s backers appealed to the CFTC on to again his plan, Behnam mentioned. They included Constancy Investments, Fortress Funding Group, and even universities from throughout the nation.

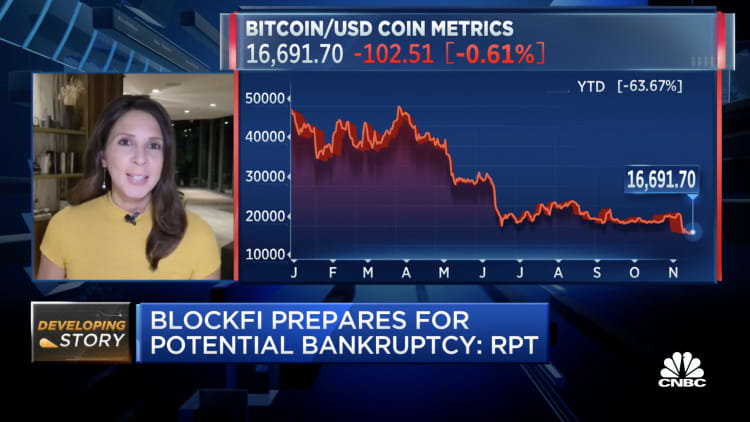

FTX, which was valued at $32 billion by non-public buyers earlier this yr, spiraled in spectacular vogue final week as reviews of liquidity issues resulted in prospects withdrawing billions of {dollars} a day from their accounts. Nonetheless, FTX did not have the capital to honor these requests as a result of it had used buyer deposits for a wide range of functions, together with for buying and selling at Bankman Fried’s hedge fund, Alameda Analysis. Bankman-Fried additionally disclosed on Twitter on Wednesday that FTX had constructed up round $13 billion of leverage.

Behnam mentioned his company’s staffers have been nonetheless within the means of reviewing FTX’s software for an amended license when FTX and roughly 130 extra affiliated firms, together with Alameda and FTX’s U.S. subsidiary collectively filed for chapter safety.

Since then, LedgerX has reportedly withdrawn its software for leveraged derivatives buying and selling.

Earlier than the implosion, Bankman-Fried had been attempting to play the position of trade savior because the crypto market sank and lenders and hedge funds went stomach up. In Could, he additionally purchased a 7.6% stake in buying and selling app Robinhood, which on the time had misplaced greater than three-quarters of its worth since its IPO final yr. In April, FTX purchased a stake in equities trade IEX.

“If you concentrate on it, looking back, along with his Robinhood acquisition and his relationship with IEX — it goes past crypto what FTX was attempting to do,” Behnam mentioned.

WATCH: Authorities eyeing bringing Sam Bankman-Fried to the U.S. for questioning

Source link