Nickel costs soar as ‘skinny’ buying and selling situations increase volatility

[ad_1]

Nickel costs have surged to the best stage in additional than six months, underlining worsening buying and selling situations since market chaos broke out in March.

The benchmark nickel contract for supply in three months surged briefly to hit the London Steel Trade’s every day buying and selling restrict of 15 per cent, reaching virtually $31,000 per tonne on Monday. That was adopted by a 5 per cent rise on Tuesday after a nickel mine in New Caledonia, which provides Tesla, minimize its fourth quarter manufacturing forecast.

Buying and selling sources mentioned that the risky worth actions have been a testomony to the low liquidity that has haunted the market for the reason that LME suspended and cancelled billions of {dollars} value of nickel trades in March following an unprecedented worth spike.

“The market remains to be very skinny. What we’ve seen is the results of low liquidity play out proper in entrance of us,” mentioned Geordie Wilkes, head of analysis at Sucden Monetary, a metals brokerage.

Nickel, which is used to make stainless-steel and the batteries utilized in electrical automobiles, has suffered a particularly turbulent 12 months. Fears of sanctions on Norilsk Nickel, a big Russian producer, collided with an enormous wager by the world’s largest stainless-steel producer, Tsingshan, that costs would fall, inflicting costs to greater than double in a matter of days in March.

Nickel costs have rallied virtually 25 per cent in 5 days off the again of optimism over the Chinese language economic system reopening and Beijing supporting the property sector, in addition to a weaker US greenback following higher than anticipated inflation knowledge.

However Nikhil Shah, head of nickel analysis at consultancy CRU, mentioned that the string of optimistic information “isn’t any justification for the rally we’ve seen” and “we might see an enormous correction over the following few months”.

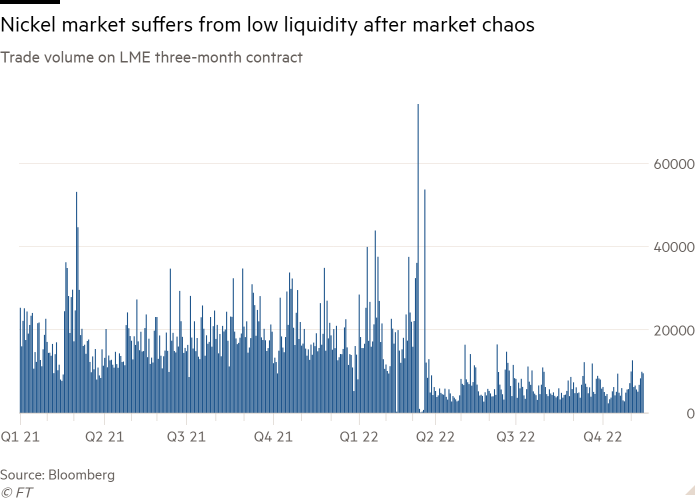

Quantity on the LME three-month nickel contract since March has been 30 per cent of ranges within the six months earlier than the market chaos, in line with Bloomberg knowledge.

Prony Sources, the proprietor of the Goro nickel mine in New Caledonia, which is partly owned by commodity buying and selling large Trafigura, mentioned in an announcement that manufacturing needed to be lowered within the remaining three months of the 12 months as a result of heavy rain induced a “restricted launch of salt-laden liquid” from its tailing dam.

Movies of a blast at a nickel pig iron plant in Indonesia have been circulating on social media on Monday however the Chinese language proprietor of the location mentioned that manufacturing had been operating as regular since starting on the finish of final month.

One nickel dealer mentioned that the first driver behind nickel’s surge was a weaker greenback exacerbated by low liquidity on the nickel contract. “Any provide facet points should not materials.”

Nickel producers are rising more and more involved concerning the detrimental influence of the volatility. Jeremy Martin, chief government of Horizonte Minerals, a London-listed developer of nickel initiatives in Brazil, mentioned that steady pricing of $20-25,000 could be preferable.

“What may be very difficult is these very vital spikes. Everyone then goes ‘we have to have another, we have to substitute and nickel is just not that steady enter commodity that we thought it was for our battery expertise’.”

Source link