What to anticipate from Warner Bros. Discovery Q3 Earnings

[ad_1]

Jacek_Sopotnicki/iStock Editorial through Getty Photos

Warner Bros. Discovery (NASDAQ:WBD) is scheduled to announce Q3 earnings outcomes on Thursday, November third, after market shut.

The consensus EPS Estimate is -$0.05 (-120.8% Y/Y) and the consensus Income Estimate is $10.33B (+227.9% Y/Y).

The corporate is anticipating to guide a pre-tax cost of $1.3B to $1.6B within the quarter for restructuring its companies.

Greater than 50% of the corporate’s revenues comes from promoting and Q3 is anticipated to have witnessed a gentle ad-spending surroundings.

Warner Bros. Discovery chief monetary officer Gunnar Wiedenfels has instructed the corporate’s streaming companies are “basically underpriced.” Wiedenfels made the feedback throughout an look on the Goldman Sachs Communacopia + Tech Convention in September, the place he mentioned Warner Bros.’ plans to merge HBO Max and Discovery+ right into a single platform subsequent yr.

Earnings Historical past:

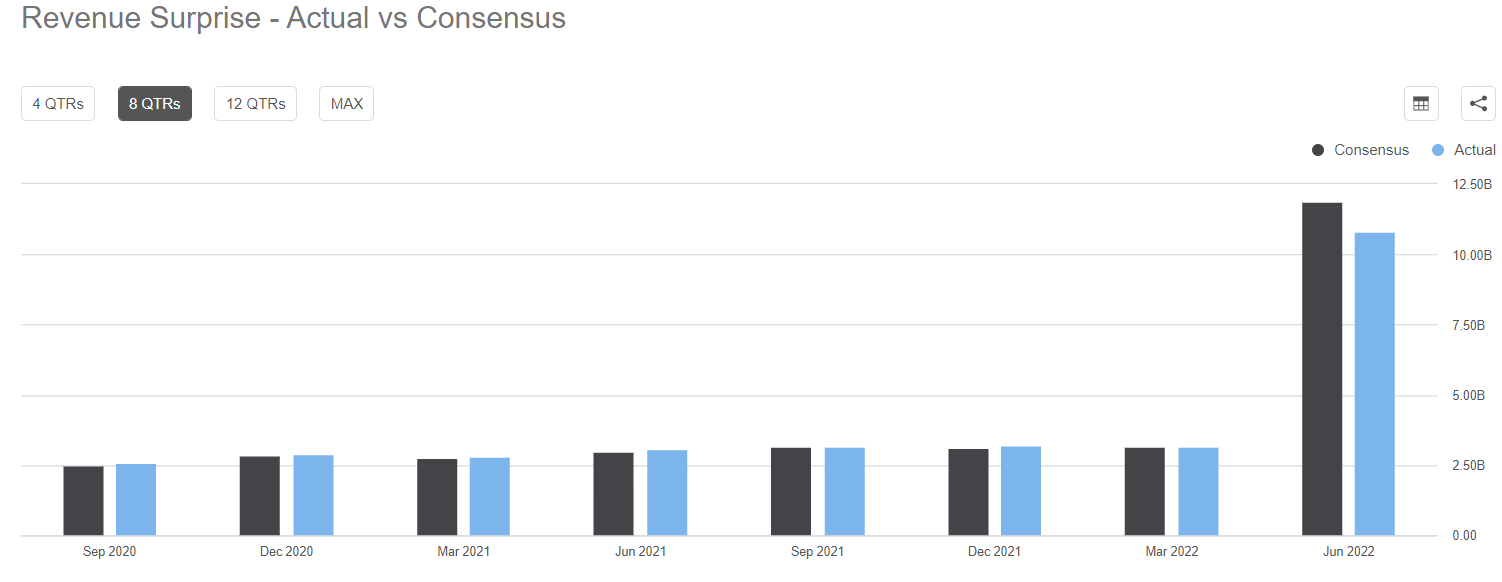

In Q2, the corporate noticed high line development of greater than 200% Y/Y and ended the quarter with 92.1M international DTC subscribers in contrast with 90.4M subscribers in Q1.

During the last 2 years, WBD has overwhelmed EPS estimates 88% of the time and has overwhelmed income estimates 88% of the time.

During the last 3 months, EPS estimates have seen 3 upward revisions and 9 downward. Income estimates have seen 3 upward revisions and 12 downward.

Analysts Scores:

KeyBanc analyst Brandon Nispel on Oct 26 lowered his estimates on the media sector, rebuilding his mannequin within the face of the group’s heavy challenges – notably the macroeconomic downturn and growing competitors for advertisements in a tricky surroundings. Nispel mentioned “the WarnerMedia belongings want fixing, which doubtless results in unfavorable underlying development” Nispel added that Warner Bros. Discovery (WBD) is unlikely to outperform amid a big pay TV enterprise and the shortage, for now, of a mixed HBO Max/Discovery+ streaming service.

Barclays lowered their worth goal on WBD from $17 to $15 on October 11.

Credit score Suisse Group lowered their worth goal from $39 to $36 and set an “outperform” score for the corporate.

10 out of 25 Wall Avenue Analysts have a Sturdy Purchase score on the inventory, 3 says to Purchase and 11 Maintain score.

SA Quant score system screens the inventory with a Maintain score.

On Apr 8, Discovery and AT&T’s Warner Media unit accomplished the merger to kind a mixed firm, Warner Bros. Discovery.

A fast have a look at the corporate’s efficiency vs. broader market index and friends:

Source link