250 years of historical past is telling buyers to wager on Treasury bonds in 2023, Financial institution of America says

[ad_1]

Benchmark U.S. Treasury bonds are dealing with their worst annual returns since 1788, however an enormous bounce is probably going within the new yr, together with a inventory rout.

That’s based on a staff of strategists at Financial institution of America led by Michael Hartnett, who checked out 250 years of historical past to conclude that bonds are headed for constructive returns in 2023, as markets pivot from “uber-bearish ‘inflation shock’ and charges shock’” to expectations for a recession.

A chart from the strategists present 10-year Treasury notes

TMUBMUSD10Y,

have misplaced an annualized 23% yr so far, and are set for a second straight annual loss. The final time buyers noticed such back-to-back losses was 1958 to 1959, mentioned Hartnett. As well as, the asset class has by no means skilled three straight years of losses, and the final time it noticed a greater than 5% loss was adopted by a constructive return in 1861, based on the financial institution.

Financial institution of America

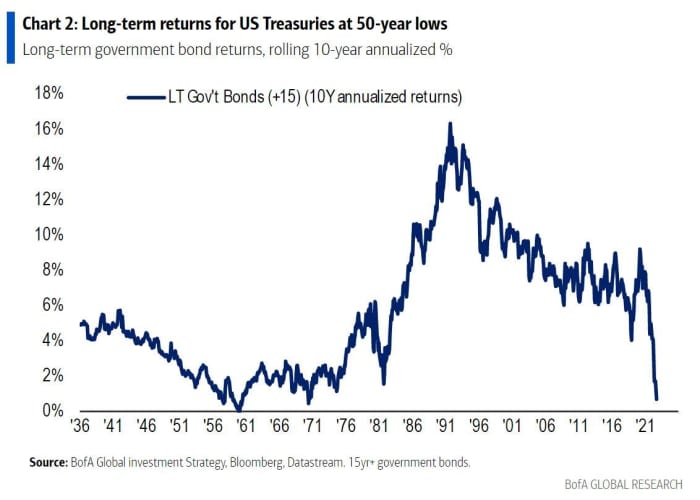

His subsequent chart reveals how the long-term return for U.S. Treasurys has crashed to a 50-year low of 0.7%, from a excessive of as a lot as 9.7% in the course of the March 2020 pandemic lows for inventory markets.

BofA

Markets have seen 243 fee will increase globally this yr, which Hartnett mentioned quantities to 1 per buying and selling day, however that the bond market is now beginning to pivot, given coverage “blinks” from the Financial institution of England, Royal Financial institution of Australia and Financial institution of Canada.

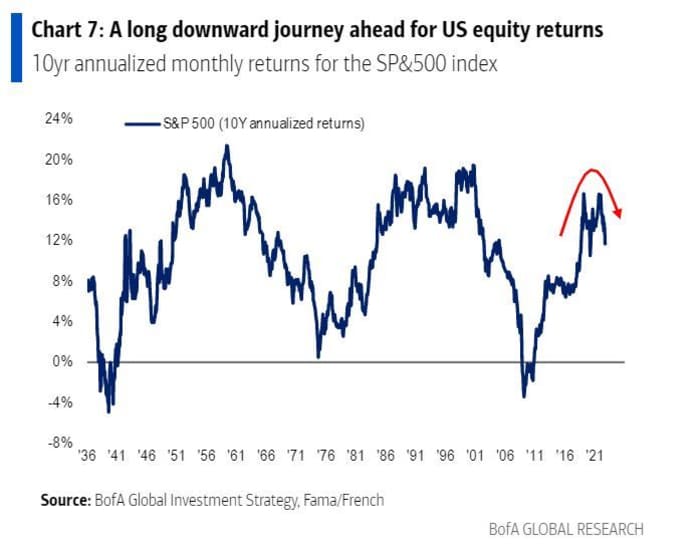

The strategist mentioned they see a “recession shock” for markets forward, which is able to result in new highs in credit score spreads, new lows for equities, possible within the first quarter of subsequent yr. That’s even when shares are establishing for a fourth-quarter rally because of excessive bearishness by buyers.

The “recession commerce is at all times lengthy bonds, quick shares,” he mentioned, offering the beneath chart.

BofA

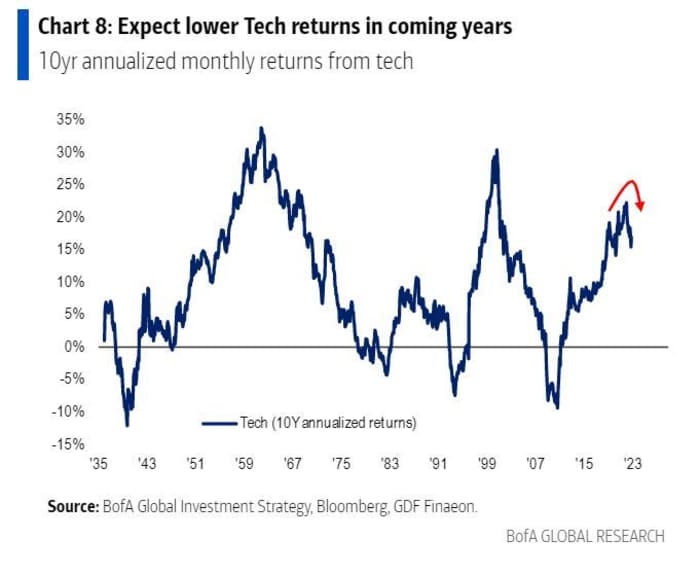

Large Tech has gone by the earnings wringer these days, with contemporary disappointment from Amazon.com

AMZN,

after Microsoft

MSFT,

Alphabet

GOOGL,

Meta Platforms

META,

and Snap

SNAP,

earnings gloom.

Opinion: Fb and Google grew into tech titans by ignoring Wall Road. Now it may result in their downfall

These losses are solely getting began, mentioned Hartnett, offering the next chart:

BofA

Opinion: The cloud growth has hit its stormiest second but, and it’s costing buyers billions

Source link