16 months after its IPO, UK on-line retailer Made.com prepares for administration • TechCrunch

[ad_1]

Made.com, a U.Ok.-based ecommerce firm that sells furnishings and associated house equipment throughout seven European markets, is bracing for insolvency because it confirmed plans to nominate directors after failing to discover a purchaser.

Based in 2010, Made.com emerged as one thing of a darling within the U.Ok. startup sphere for the way in which it labored with choose companions to optimize the complete furnishings design and manufacturing course of, whereas maintaining its overheads down by a largely on-line platform (although it has dabbled with bodily shops by the years). The corporate went on to boost round $137 million from a few of Europe’s main traders.

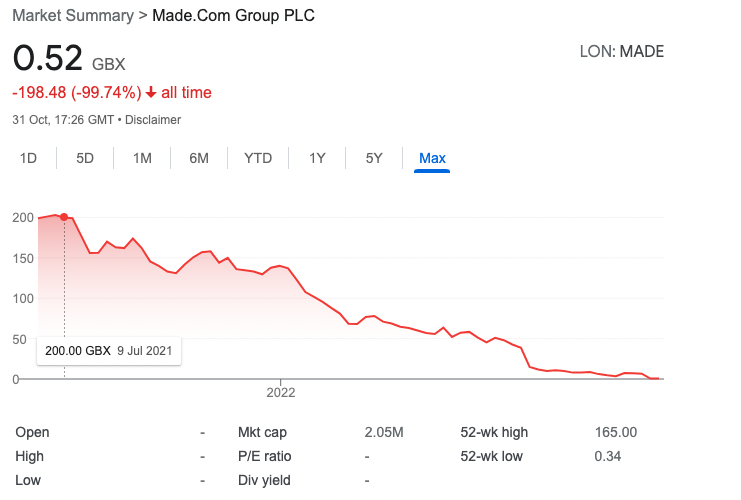

Immediately’s information comes a bit of greater than a yr after the London-headquartered firm went public on the London Inventory Trade, a transfer that instantly noticed its shares fall 7% on its first day of buying and selling. Made.com priced its shares initially at 200 pence, giving it a valuation of round £775 million ($894 million), however its fortunes by no means fairly recovered from that inaugural day in June 2021, as its inventory persevering with to plummet within the intervening months to an all-time low of 34 pence.

Made.com’s downfall

Immediately’s announcement ought to maybe come as little shock. Made.com revealed again in September that it was contemplating job cuts and a possible sale, after struggling by the hands of the financial downturn and disruptions to its provide chain. Certainly, the corporate’s losses widened within the first half of this yr, rising from £10.1 million in H1 2021 to £35.3 million.

Whereas Made.com did beforehand report that it was in lively discussions with potential patrons, issues took a flip for the more severe final week when the corporate ceased taking new orders and revealed that it wouldn’t be processing any requests for refunds or returns. With the clock ticking to discover a purchaser by the tip of October, Made.com has now confirmed that not one of the events had been capable of “meet the mandatory timetable” for closing a deal, and discussions have now been terminated.

With PricewaterhouseCoopers lined up as directors, Made.com has now briefly suspended buying and selling of its extraordinary shares, although this in all probability will result in a everlasting cancellation as soon as the administration plans are rubberstamped.

Source link