$1 billion to $2 billion of FTX buyer funds lacking: Report

[ad_1]

Sam Bankman-Fried, co-founder and chief govt officer of FTX, in Hong Kong, China, on Tuesday, Might 11, 2021.

Lam Yik | Bloomberg | Getty Photos

As Sam Bankman-Fried’s FTX enters chapter safety, Reuters experiences that between $1 billion to $2 billion of buyer funds have vanished from the failed crypto change.

Each Reuters and The Wall Road Journal discovered that Bankman-Fried, now the ex-CEO of FTX, transferred $10 billion of buyer funds from his crypto change to the digital asset buying and selling home, Alameda Analysis.

associated investing information

Alameda, additionally based by Bankman-Fried, was thought of to be a sister firm to FTX. These cozy ties are actually underneath investigation by a number of regulators, together with the Division of Justice, in addition to the Securities and Trade Fee, which is probing how FTX dealt with buyer funds, in accordance with a number of experiences.

A lot of the $10 billion despatched to Alameda “has since disappeared,” in accordance with two individuals talking with Reuters.

Reuters disclosed that each sources “held senior FTX positions till this week” and added that “they have been briefed on the corporate’s funds by high workers.”

One supply estimated the hole to be $1.7 billion. The opposite put it at one thing within the vary of $1 billion to $2 billion.

It seems that Reuters reached Bankman-Fried by textual content message. The previous FTX chief wrote that he “disagreed with the characterization” of the $10 billion switch, including that, “We did not secretly switch.”

“We had complicated inside labeling and misinterpret it,” the textual content message learn, and when requested particularly concerning the funds which are allegedly lacking, Bankman-Fried wrote, “???”

Emergency assembly within the Bahamas

Final Sunday, Bankman-Fried convened a gathering with executives in Nassau to take a look at FTX’s books and determine simply how a lot money the corporate wanted to cowl the outlet in its stability sheet. (Bankman-Fried confirmed to Reuters that the assembly occurred.)

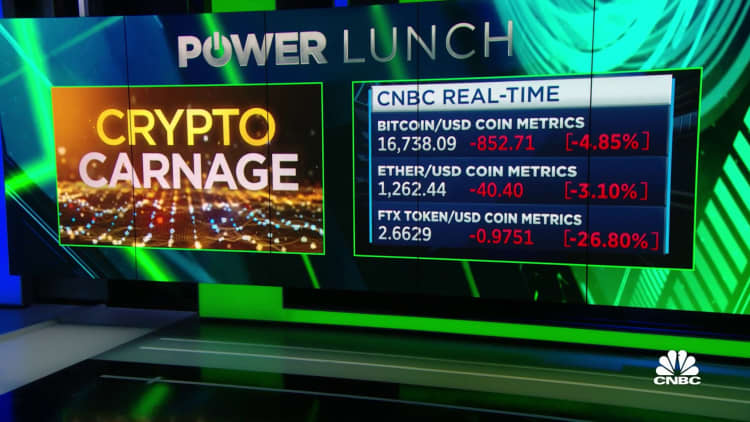

It had been a tough few days of commerce for FTX after Binance CEO Changpeng Zhao tweeted that his firm was promoting the final of its FTT tokens, the native forex of FTX. That adopted an article on CoinDesk, stating that Alameda Analysis, Bankman-Fried’s hedge fund, held an outsized quantity of FTT on its stability sheet.

Not solely did Zhao’s public pronouncement trigger a plunge within the value of FTT, it led FTX prospects to hit the exits. Bankman-Fried stated in a tweet that FTX shoppers on Sunday demanded roughly $5 billion of withdrawals, which he known as “the most important by an enormous margin.” That was the day of SBF’s emergency assembly within the Bahamian capital.

The heads of FTX’s regulatory and authorized groups have been reportedly within the room, as Bankman-Fried revealed a number of spreadsheets detailing how a lot money FTX had loaned to Alameda and for what objective, in accordance with Reuters.

These paperwork, which apparently mirrored the latest monetary state of the corporate, confirmed a $10 billion switch of buyer deposits from FTX to Alameda. Additionally they revealed that a few of these funds — someplace within the vary of $1 billion to $2 billion — couldn’t be accounted for amongst Alameda’s belongings.

The monetary discovery course of additionally unearthed a “again door” in FTX’s books that was created with “bespoke software program.”

The 2 sources talking to Reuters described it as a means that ex-CEO Bankman-Fried may make modifications to the corporate’s monetary document with out flagging the transaction both internally or externally. That mechanism theoretically may have, for instance, prevented the $10 billion switch to Alameda from being flagged to both his inside compliance staff or to exterior auditors.

Reuters says that Bankman-Fried issued an outright denial of implementing a so-called again door.

Each FTX and Alameda Analysis didn’t instantly reply to CNBC’s request for remark.

Source link